Capuchin Fr. Mike Crosby is a capitalist. He believes in the market, making a profit and having a diverse investment portfolio. He isn’t a cutthroat Wall Street broker in a suit looking for the next big buy, but he is on the lookout for an opportunity to change a business from within.

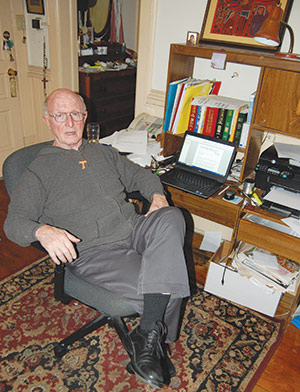

Capuchin Fr. Mike Crosby sits in his office at St. Benedict the Moor Parish, Milwaukee. Fr. Crosby has been a member of the Interfaith Center for Corporate Responsibility since 1973 and helped start the first Catholic coalition within the group. (Catholic Herald photo by Ricardo Torres)“When an issue comes up that has moral implications, we want to try to address the corporation,” Fr. Crosby said. “There are times when we will buy stock in a company in order to engage them.”

Capuchin Fr. Mike Crosby sits in his office at St. Benedict the Moor Parish, Milwaukee. Fr. Crosby has been a member of the Interfaith Center for Corporate Responsibility since 1973 and helped start the first Catholic coalition within the group. (Catholic Herald photo by Ricardo Torres)“When an issue comes up that has moral implications, we want to try to address the corporation,” Fr. Crosby said. “There are times when we will buy stock in a company in order to engage them.”

In 1973, Fr. Crosby was one of the first Catholics to join the Interfaith Center on Corporate Responsibility (ICCR), an organization created by Protestants to create a social ministry focused on investments. Eventually, he helped start the first Catholic coalition within the group.

He explained the purpose of the group is to make sure portfolios are profitable, but also that the companies are making positive contributions to society.

As shareholders, group has a voice

The concept behind ICCR is simple. When a business has particular practices with which the group does not agree, ICCR buys enough stock to be able to file a shareholders resolution to amend the practice or change the corporate environment.

“(Shareholders) are invested in the stock market in some kind of way,” Fr. Crosby said, explaining they are owners of stocks, bonds or mutual funds. “They got investments somewhere. We’re saying if you’re invested, you’re responsible and you can’t just be in the market on the terms of the market.”

To do that, the coalition starts by buying at least $2,000 worth of stock of a publicly traded company and holds that stock for at least one year. That’s enough for them to send a representative to shareholder meetings, propose shareholder resolutions and have an audience with high-level executives. They’re allowed one shareholder resolution per company.

However, each coalition “screens” companies with which it doesn’t want to do business. Each coalition determines its screens based on its own particular beliefs.

“Our two screens are abortifacients or 10 percent of (a company’s) earnings are coming from nuclear weapons production,” Fr. Crosby said.

Investments will not be made in any company that produces drugs or chemicals used for abortion or

in the market for justice series |

contraceptives, along with companies receiving profits from nuclear weapon production, according to Fr. Crosby.

“The Protestants have traditionally screened out what they call the sin stocks: alcohol, gambling and tobacco,” he said. “Catholics got no problem with alcohol, gambling and tobacco.”

The Catholic groups from Wisconsin, Iowa, Michigan, Minnesota and South Dakota comprise the Seventh Generation Interfaith Coalition for Responsible Investment (Seventh Generation CRI). In Wisconsin, Catholic organizations that are members include the Capuchin Franciscan Province of St. Joseph, the School Sisters of Notre Dame, the School Sisters of St. Francis and the Diocese of Green Bay — the only Wisconsin diocese that is a member of ICCR.

Investing aids students at St. Lawrence

The portfolio owned by the Capuchin Franciscan Province of St. Joseph is used to help keep a low cost of tuition, room and board at St. Lawrence Seminary High School, Mt. Calvary.

“That difference is made up by the portfolio; that’s millions of dollars in that portfolio to help run that ministry,” Fr. Crosby said. “Our portfolio is to generate the money for the teachers, and the running of (the seminary). Our portfolio to pay for the health care expenses of our workers and our friars is split 60-40.”

Fr. Crosby said roughly 60 percent of the portfolio is equity, 40 percent is bonds.

Once a company’s portfolio passes the screens, there is a list of issues ICCR tries to address.

“What about climate change? What about human rights violations?” Fr. Crosby said. “That’s my job, to engage the companies on these social issues.”

On the issue of climate change, Fr. Crosby said he’s been in contact with ExxonMobil Corp.

“I’ve been in dialogue on the issue of climate change with ExxonMobil since 1997,” he said. “It took them 10 years to even admit there was (climate change) and that there were human factors contributing by the burning of fossil fuels.”

In the 2015 ICCR Proxy Resolutions and Voting Guide, the report details “the evolution of ExxonMobil’s management strategy in response to the severity of the climate crisis has been wholly inadequate. We urge the company to create a disciplined business strategy with goals to reduce GHG (green house gas) emissions.”

Kohl’s earns postive feedback on environment

Another company with which ICCR regularly interacts is Wisconsin-based Kohl’s Corp., which touts its reputation on environmental issues. One example they state is that their stores and corporate buildings are all LEED (Leadership, Energy, Environment, Design) certified, affecting over 430 buildings nationwide.

“They’re doing very, very good work on environment,” Fr. Crosby said. “I don’t know of another company that’s doing a better job on environmental issues. They’re very forward on that.”

Fr. Crosby said he wishes Kohl’s would be as forward with closing the wage gap between top executives and lower store employees as they are on environmental issues.

“But they won’t talk about wages … no company wants to talk about wages,” Fr. Crosby said about ICCR’s efforts to try to get Kohl’s to raise its minimum wage.

According to PayScale, an online salary, benefits and compensation information company, an hourly rate for a Kohl’s cashier ranges from $7.30 to $9.31; a retail sales associate ranges from $7.46 to $10.77; and a point of sale coordinator ranges from $6.69 to $15.78.

“One of the arguments on why a company can disallow a shareholder resolution is if you talk about minimum wage,” Fr. Crosby said. “They say that’s ordinary business; you cannot interfere with the way we do ordinary business.”

In November 2014, ICCR filed a shareholder resolution asking for “a review of our company’s executive compensation policies and make available upon request a summary report of that review by Oct. 1, 2015…. We suggest the report include: 1) a comparison of the total compensation package of the top senior executives and our store employees’ median wage from the United States in July 2005, 2010 and 2015; and 2) an analysis of changes in the relative size of the gap along with an analysis and rationale justifying any trends evidenced.”

Along with the request, the shareholder resolution contained research supporting its argument. The ICCR noted that in 2013, CEO Kevin Mansell had a compensation package of $8,178,304 while the board of directors rated Mansell’s performance “satisfactory.” That same fiscal year, the top five executives’ salaries totaled $31,347,997.

The resolution also stated that the “average annual compensation for Kohl’s store associates ranged from $15,390 to $24,856.” The ICCR attributed those figures to PayScale.

The resolution didn’t clarify if the annual compensation for store associates was for full-time or part-time workers.

On Nov. 14, 2014, Fr. Crosby wrote a letter to the corporate secretary of Kohl’s Corp., asking for a “constructive conversation on this issue and (to) share ideas on how to lessen the pay gap between those in the highest income brackets and those whose wages are unable to ensure them of a living wage.”

When ICCR proposes a shareholder resolution, Fr. Crosby says group members only go through that work when they know they have a good chance of it passing. When a resolution is filed, the company receiving it has three options:

- It can place it on the agenda during the annual shareholders’ meeting to be voted on and the company can advocate for or against the resolution.

- It can dialogue with the shareholder to try to change his or her mind and withdraw the resolution.

- It can challenge the resolution with the U.S. Securities and Exchange Commission (SEC).

Kohl’s challenges pay gap resolution

Fr. Crosby said when a resolution is challenged at the SEC, it most likely means the company doesn’t want the resolution to be taken up for a vote.

On Jan. 5, 2015, Jason J. Kelroy, assistant general counsel for Kohl’s, sent a letter to the SEC, which requested “the staff” agree to omit the shareholder proposal by the Province of St. Joseph of the Capuchin Order “because it is so vague and indefinite so as to be misleading.”

The letter stated that terms like “top senior executive,” “total compensation package,” and “store employees’ median wage” need clarity.

On the issue of the use of “wage” in the resolution, the letter states: “Similar to ‘total compensation package,’ the shareholder proposal’s use of ‘wage’ is confusing since the shareholder proposal does not clarify whether wage should be limited to fixed cash salary or if it should include accrued vacation, health care or other benefits.”

The letter was sent to the SEC’s division of corporation finance, specifically to the office of the chief counsel, and emailed to Fr. Crosby. The letter indicated Kohl’s would challenge the shareholder resolution in front of the SEC.

“We’re not a bunch of Marxists trying to take the company down,” Fr. Crosby said. “We’re just faith-based people saying we’ve got to balance our fiscal responsibility with our social responsibility. We just can’t be in the market on its terms. We’re not in the market on the terms of Wall Street; we’re on the terms of the Gospel of Jesus Christ.”

Two weeks after the Kohl’s letter, Jan. 19, 2015, attorney Paul Neuhauser, representing the Province of St. Joseph of the Capuchin Order, responded with a letter to the SEC.

Neuhauser claimed “the company” (Kohl’s) didn’t fully understand what “the proponent” (the Capuchins) was actually asking for and focused only on a review of executive compensation policies.

“What is missing from this erroneous description of the proponent’s proposal? The entire crux of the proposal, namely, that the company disclose (i) the ratio of the compensation of the senior executives with that of the average worker and (ii) if that ratio has changed over time and an explanation of why it has changed,” he wrote.

In the letter, Neuhauser responded to the argument that the shareholder resolution uses vague terms (like “top senior executive,” “total compensation package,” store employees’ median wage”), saying that shouldn’t disqualify the resolution from being voted on at the annual shareholders’ meeting.

“We have confidence that neither the shareholders nor the board is lacking in intelligence or common sense,” Neuhauser wrote.

Companies dialogue with ICCR

The process of passing shareholder resolutions can be frustrating, but for Fr. Crosby, he’s confused as to why Kohl’s would fight back at the SEC because other companies, where they’ve filed similar resolutions, decided not to fight them.

“(Walmart) didn’t fight us. They dialogued with us and told us they were going to do something; Kohl’s didn’t,” Fr. Crosby said. “Kohl’s has not dialogued with us on the issue. Walmart has. TJX has. Target has. So a lot of its (Kohl’s) major competitors have at least talked with us about it. Kohl’s won’t talk with us.”

New member comes from corporate world

It can be difficult for faith-based groups to communicate with business, but recently the Seventh Generation CRI has added a member from the corporate world.

Frank Sherman is a former general manager at AkzoNobel Global, a producer of paints, coating and other specialty chemicals, based in Amsterdam.

Having retired in 2012, Sherman and his wife settled in the Milwaukee area after their children graduated from Marquette University and UW-Madison. They attend St. Benedict the Moor Parish, Milwaukee, and Fr. Crosby approached Sherman about joining ICCR.

“I was quite surprised as to how much attention our coalition, the national coalition, gets from companies and management,” Sherman said. “Not that it’s easy, but they do have access to top management and to, in some cases, boards of companies.”

Having Sherman’s business experience is a benefit for ICCR.

“The other interesting thing is dealing with a business community I understood and grew up in, albeit, on the other side of the boardroom table,” Sherman said. “I advocate with companies to do the right thing and think beyond profits.”

The issue of income inequality is one of the main focuses for ICCR, and according to its 2015 Proxy Resolutions Voting Guide, it has filed shareholder resolutions related to pay disparity to 12 companies.

“Their pay philosophy is to fill the jobs as cheap as they can,” Sherman said. “I was there. I did it. I know it.”

The strategy of buying stock to get a seat at the table could have a stronger impact than picket lines in front of buildings.

“For me, if someone threatens you, it may change your behavior but it won’t change your mind,” Sherman said. “On the other hand, if I have a conversation with you and I give you evidence, that you ultimately change your mind … that, I think, is more sustainable.”

In February 2015, Doug McMillon, CEO and president of Walmart, announced the company would raise the minimum wage for its full-time workers to $13 per hour by April 2016. It was a surprise to many, but not to shareholders.

“(McMillon) told us (in summer 2014) … ‘we will not fight a federal minimum wage increase,’ which was a big statement,” Sherman said, adding the ICCR pay disparity shareholder resolution was discussed with the Walmart board of directors and that the move by Walmart will have a ripple effect in the business world. “It’s going to put a lot of pressure on the other guys.”

The shareholder resolution ICCR filed with Walmart was similar to the one filed with Kohl’s, which asked for a comparison of the total compensation packages to the median wage of store employees, along with analysis to the changes over time to the pay gap.

This shareholder resolution wasn’t fought by Walmart at the SEC, unlike the resolution filed with Kohl’s.

“They don’t want to talk about pay to the supply chain or their employees here,” Sherman said. “Kohl’s is a good company, but when we talk about a living wage to their supplier in Bangladesh, they come back with, ‘We pay the legal required minimum’… that doesn’t satisfy us.”

SEC rules in favor of Kohl’s

In the summer of 2015, the SEC ruled in favor of Kohl’s and the shareholder resolution wasn’t taken up for a vote at the annual shareholder meeting. According to ICCR, when a resolution is omitted because of the SEC ruling, the shareholder cannot re-file the resolution for another three years.

“Kohl’s went to the SEC and to this day is not (talking about), does not want to talk about the worker pay,” Fr. Crosby said. “They still are chafing at the fact that we filed that resolution. They do not like the fact that we did that.”

Fr. Crosby said the organization won’t re-file with Kohl’s on that issue, because the Dodd-Frank Wall Street Reform and Consumer Protection Act will require businesses to provide that information.

In August 2015, the SEC announced it had adopted the “final rule that requires a public company to disclose the ratio of the compensation of its chief executive officer (CEO) to the median compensation of its employees.” It continues, “Companies will be required to provide disclosure of their pay ratios for their first fiscal year beginning on or after Jan. 1, 2017.”

Even though they had lost at the SEC, Fr. Crosby said this is a step in the right direction, but the ICCR will need to do more on the issue of pay disparity.

“The thing that we were more concerned about, not the average worker or the median worker, but the lowest paid worker,” Fr. Crosby said. “That’s what we were concerned about.”

Public percecption of business changing

The efforts of the different coalitions of ICCR and similar groups have had a profound impact on how citizens view corporate behavior.

Kevin Gibson, associate dean of the graduate school at Marquette University, said public perception of the business world has changed.

“I’ve been teaching business ethics for probably 25 years now and when I first engaged in this, we didn’t use words like ‘stakeholder’ or ‘corporate social responsibility’ at all,” Gibson said. “I think that the language that is used has changed over the years.”

Gibson said groups like ICCR have great potential to change businesses.

“The notion of being part of the organization and changing it from within has great hope; I’m very optimistic about it,” Gibson said, adding there is a connection between people and business. “In a symptomatic way, we are the public, the public makes the rules and the rules are followed by business.”

Income inequality is a complex issue with no easy answers.

“I’m all for paying people more; I think that increasing wealth generally primes the pump and does well in the system,” Gibson said. “Otherwise you’re sort of faced with a race to the bottom where people aren’t being paid and they don’t have money to buy things. Then the system degenerates.”

One aspect of pay disparity is the overall performance of the company.

“If the CEO is making a whole bunch of money and everyone else is doing well at the same time, then he or she is probably worth that money,” Gibson said. “It depends on if the CEO is making the money at the cost of everything else.”

For Kohl’s, despite achieving revenue of $19 billion in 2014 and 2015, its annual proxy statement filed this year states “because we did not achieve all of our financial goals in 2013 or 2014, our NEOs (Named Executive Officers) received the minimum payout possible under our annual incentive program in each of those years.”

Kohl’s outperformed its “core peer group” of other companies — The Gap, Inc., Nordstrom, Inc., and L Brands Inc. and more — which is why the top executives received the minimum.

The same paragraph states, “because we did not achieve all of our financial goals in 2013 or 2014, certain performance-vested restricted shares granted to three of our NEOs in April 2013 did not vest and were subsequently cancelled. Taken as a whole, this reflects Kohl’s strong commitment to only paying for meaningful performance.”

Despite performing poorly, Kohl’s’ competition did worse and therefore the company’s top executives received a performance rating of “effective” and each received a 2.25 percent base salary increase.

Large termination package questioned

On March 24, 2014, Kohl’s’ chief merchandising officer Donald A. Brennan agreed to the “termination of his employment” effective, April 1, 2014, due to poor performance. In the proxy statement “benefits and payments under the agreement were contingent upon Mr. Brennan agreeing to a general release of claims against us.”

Brennan’s payouts for being terminated included 17 percent of the bonus he would have received had he lasted the whole year, which equaled $47,287. It included payments equal to 2.9 times his base salary, which equaled $2,688,884.

He also received a severance payment (bonus payment) equal to the “average award to Mr. Brennan for the three most recent fiscal years,” which totaled $529,745.

The agreement also included $20,000 for “outplacement,” normally used for employees who might need some assistance finding another job. In addition, he received $4,598,414 worth of restricted stock and $532,318 worth of “continued vesting of stock options.”

The termination package for Brennan was worth $8,416,648. Brennan and his family were also allowed to keep their health care insurance provided by Kohl’s Corp.

For Fr. Crosby, this type of expenditure on one employee is the type of behavior against which Pope Francis speaks.

“Here, I’m involved in the stock market and dealing with these companies,” Fr. Crosby said. “Our goal is to bring the Gospel values into the marketplace and this is how we do it.”

A successful business, Sherman believes, involves input from all facets and allows for all to benefit. He added those things don’t always appear on a PNL (Profits and Loss) report.

“Part of my business strategy was to emphasize sustainability … it’s a multi-stakeholder approach,” Sherman said. “To emphasize one stakeholder, for example, the shareholder … is too shortsighted. You need something from all stakeholders to operate.”

Shareholders can use their position for moral good.

“Some people in business believe the role of business is to maximize return to investors,” Gibson said. “And whatever track they need to do that, they will follow it. As an investor you’re looking at this and thinking, what is my mission here? Am I just trying to maximize return or am I trying to get a decent return and not make the world worse in doing so?”

Kohl’s announces changes, wage hikes

Last month, Kohl’s announced in a press release it will close “18 underperforming stores, representing less than 1 percent of total sales. The specific locations will be announced by the end of March.”

In a Feb. 25, 2016 conference call available on the Kohl’s website (www.kohls.com), Mansell said the company will assist employees at those 18 stores.

“I’m very happy to say that every affected Kohl’s store associate will be offered a opportunity to work at a nearby Kohl’s store location,” Mansell said. “Or, if they prefer, a competitive severance package.”

“The closures are expected to generate (selling, general and administrative expense) savings of approximately $45 million and annual depreciation savings of approximately $10 million,” according to the press release.

It stated the company will be charged $150-170 million as a result of planned closures and organizational realignment.

Kohl’s will open seven smaller pilot stores in various regions around the country, two “off-aisle” pilot stores, and 12 Fila outlet stores.

In the conference call, Mansell implied the savings the company will receive from closing 18 stores will have an impact on the company at large in numerous areas including wages.

“The 35 to 40 percent of our expense that is essentially store payroll, that’s going up, so we’re planning on it going up. That’s a fact.” Mansell said. “Our average hourly wage is going up.”

Kohl’s declinded the Catholic Herald’s request for an interview.